With Christmas holidays fast approaching, many of you may feel a bit stressed with the thought of the expenses that usually come hand-in-hand this time of the year. Last year, the average American spent more than $900 on holiday gifts while the 2017 holiday spending is expected to be around 4% higher than last year. But, what if you don’t have those extra $900 to spare? Don’t worry. There is still time to build that stash and go all out this holiday. Besides becoming an Uber driver using your car, freelacing, or filling out surveys, which is more or less the way most people make some extra cash year round, there are also other not so typical ways to increase your Xmas shopping fund before the festivities start!

Open a Brokerage Account

Many brokerages offer promotions at around the end of each year to attract new clients. For example, Wealthsimple offers you up to $100 cash back if you open a new account with them. If you choose to start investing with them, there is no minimum balance. So, you get extra cash that you can use to invest in the stock market or even rollover your old 401(k).

Open a Savings Account

Even if this doesn’t sound like a good idea, opening a savings account will help you make extra money before Christmas for sure. Plus, it allows you to have a little something aside for an emergency. At the moment, banks like Barclays, pay 1.30% on your spare money and you can open an account with them with no minimum balance. Worths checking out.

Moreover, you could consider an automated savings app, like Qapital, which make the saving process quite fun and easy. First, you will need to decide on what you want to start saving for (Christmas presents, in our case, or it could be anything else you many need money for in the coming months). Set some rules and watch money being transferred into your Qapital account when these goals are met.

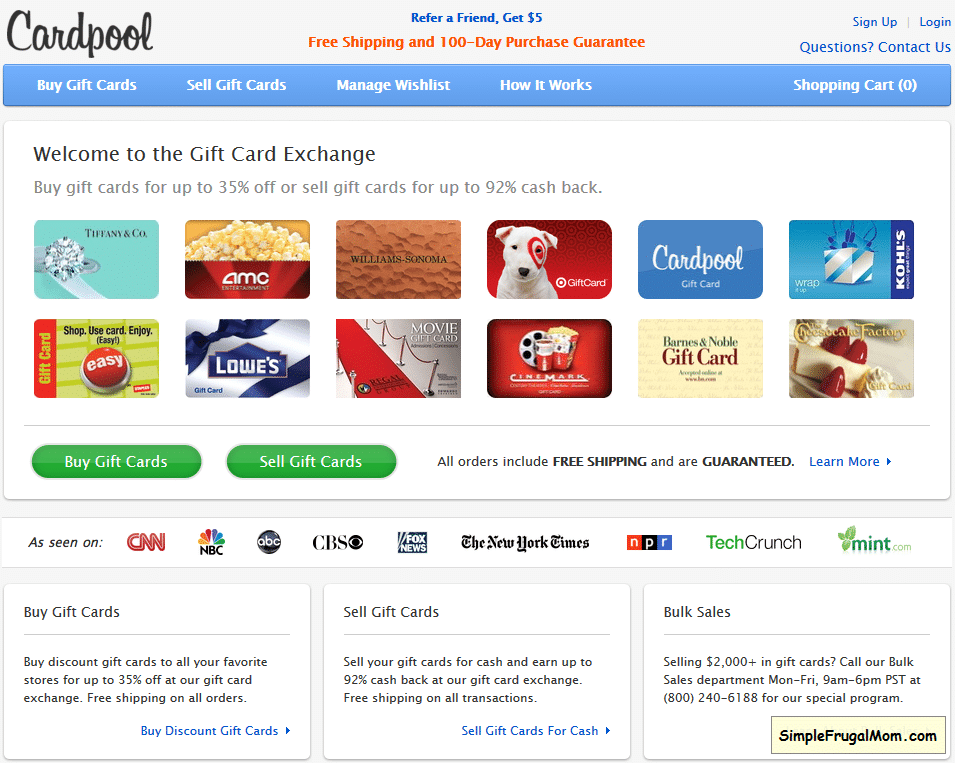

Turn Plastic Into Cash

Do you have gift cards from last year that you don’t know how to use? A great way to benefit from them is to cash them. If you look around, you will find several companies (i.e. Cardpool) that are willing to take your gift cards and give you cash you can use any other way you wish.

Shop Online, Share Receipts & Pad Your Bank Account

There are plenty of ways to do that. From better deals to cash-back websites, shopping online will get you some money back. For instance, Earny scans your inbox for receipts. If it finds price drops on your purchases, it negotiates the difference on your behalf, by benefiting from the credit card company or retailer price protection policies, and gets you a refund (whenever possible)! You may use this service to be 100% sure you are getting the best price on every single thing you buy for the holidays and earn refunds that you never thought would come your way.

Sell Your Unused Stuff

You may have received an Xmas gift that you found rather uninspired and uncreative. Chances are you also have lots of stuff you no longer use or need lying around the house. Wouldn’t you just love to declutter, get rid of all that junk, and earn money for doing so? There are tons of apps you could use, such as Letgo or Decluttr, which offer you a platform where you can sell practically everything you don’t need. Just take a flattering photo of the thing(s) you want to sell and create your listing. It won’t take you more than a couple of minutes.

Get Paid to Watch Videos

Although hard to believe, there are apps that actually pay you to do exactly that; watch videos. These videos are sponsored by brands that want to get more exposure during the festive season, and not only. One such app is InboxDollars, where you only need to watch ads. Then, they will credit your account with some small amounts of cash. The more videos you watch; the more money you will put in your pocket. Plus, an extra $5 for signing up.

Make Everyday Purchases & Earn Cash Back

Apps like Dosh (available on both Google Play and the App Store) give you cash back from your purchases at restaurants, online stores, and hotels (lists over 100,000 merchants so far). You set it once and then forget all about it. The app will automatically monitor your purchases and give you cash backs as rewards. There are also regular promotional campaigns going on that can get you extra money, such as the $25 bonus you will get if you book your first hotel through the app. Not to mention other bonuses, such as for referring local businesses and friends.

Invest Your Digital Spare Change

Opening an investment account with a company like Acorns will allow you to start saving money without even realizing it. You connect Acorns to your bank account and credit/debit cards you may have. Every time you shop online, Acorns rounds up your purchases to the nearest dollar. The difference is automatically invested for you.

Setting up an account with them is easy and can be completed in less than 10 minutes. This can help you save some decent cash without feeling that you are stretching your budget. Plus, you get an extra $10 upon your first investment.

Get Cash Back on Your Groceries

Speaking of everyday purchases, your trip to the nearest grocery store can also leave you with a few more bucks in your pocket. How? Apps like Ibotta have different cash-back offers every week so you can get cash on everything from cosmetics and apparel to milk, eggs, and bread. Before you go to the grocery store, browse their cash-back offers and make your purchases accordingly. However, try not to buy things that were not on your grocery list in the first place just because there is an offer for them. This could cost you more instead of allowing you to earn some extra money. When you have earned $20 cash back, you can transfer your cash to PayPal, gift cards or Venmo. You may also combine Ibotta’s offers with store or manufacturer coupons on the things you buy and save even more!

Tip: An extra way to get your hands on some free money every time you pay for your groceries is to utilize your credit card rewards. Of course, this can only work if you pay off the monthly balance on your credit card(s). If you don’t, then you will pay unnecessary money on interest so you will get the exact opposite results than what expected. That being said, you can consider the CashForward Barclaycard (or any other card with the same benefits) that will get you a $200 bonus for signing up and spending $1,000 within three months. There is no annual fee and you also earn 1.5% cash back on every purchase and a 5% redemption bonus. Not so shabby, right?

Complete Healthy Activities & Earn Money

This world is full of opportunities to make some extra money while doing the things you love. For example, some health apps will pay you for completing healthy activities. For instance, Achievement will give you an Amazon Gift Card or $10 in cash when you reach 10,000 points. You simply need to connect the app to a workout app (i.e. Run Keeper, Fitbit, Healthkit or any other app that helps track your fitness and health goals) and earn money for doing things like meeting your step goals with Fitbit (you get to decide which information you want to share with Achievement). That aside, the app will give you 10 points just for signing up with them and connecting an app.

Other Cash-Generating Activities to Consider

Rent a second property you may have – You may list your spare apartment or holiday home on Airbnb to create a new stream of income or just earn some side money for the holiday spending.

Deliver meals – Look around for opportunities to make cash for delivering meals (i.e. Door Dash).

Wrap presents – You will find more than enough jobs that ask for seasonal gift wrappers. You may start your search from Indeed and take it from there!

Decorate – If you have a knack for decorating, there are tons of people who would love for you to handle that task for them.

Of course, you could always bake goodies or food for in-home Christmas parties and office parties and get paid for it, or even help hang Christmas lights/decorate people’s yards (yes, many Americans hire professional companies to do that). If you make a little time each week from now until Christmas to focus on any of the activities mentioned above (or even combine a few) you can easily build a shopping fund that will allow you to spread the happiness you want around you!